Record number of people contacting us in 2018

Single parents the fastest rising group seeking debt help

3 April, 2019

Our new Statistics Yearbook 2018 published today reveals the ever-increasing scale of demand for debt help in the UK. We received 657,930 new contacts in 2018, up from 619,946 in 2017. Around 60% of new contacts are now online, with around 40% by telephone.

The profile of people seeking help and the type of debts they have continues to change over time. There has been a particularly notable increase in single parents, 85% of them women, seeking help.

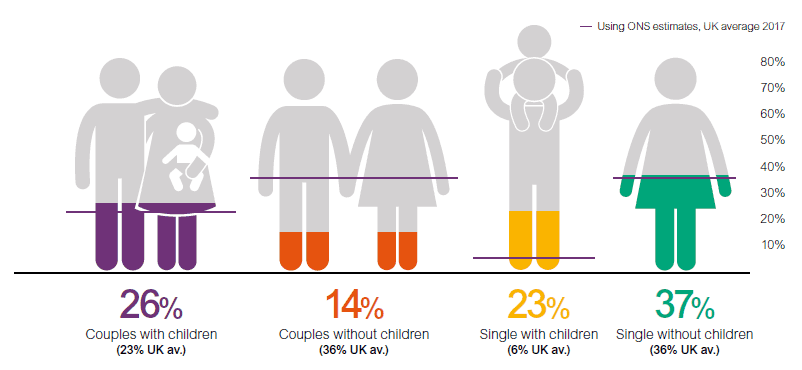

In 2018, 23% of those who took debt advice were single parents, up from 21.5% in 2017, having steadily risen from 18% since 2014. With single parents accounting for only 6% of the UK population, they're increasingly over-represented among people experiencing problem debt.

Family composition

We're seeing an increase in the proportion of clients whose debt problems have been triggered by a reduction in income. The top three reasons for debt are unemployment or redundancy (17%), injury or illness (16%) or other reduced income (17%). One in nine clients (11%) attributes their debt problems to a lack of budgeting – down from one in five (20%) just two years earlier.

Continuing the trend seen in recent years, last year the average age of new clients continued to fall. The average age of a new client was 40, down from 41 in 2017, and two thirds of clients were under 40, compared to just half (51%) in 2014. The majority of clients were in work, and more than four out of five (82%) rented their home.

The proportion of new clients 'behind on the basics', in arrears on at least one priority household bill at the time they sought advice remained stubbornly high, at 39%. The most common arrears were on council tax, with rent and utility bills also featuring.

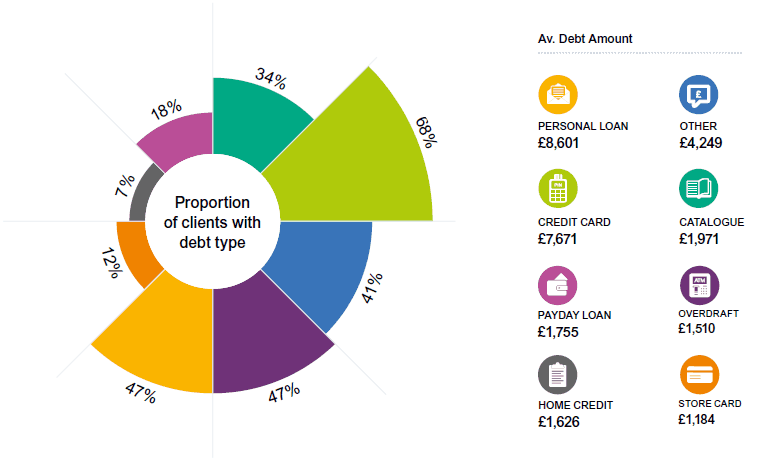

On consumer borrowing, the most common form of debt among clients was once again credit card debt, with 68% having this type of borrowing at the time they sought advice, followed by overdrafts and personal loans.

We've introduced a new service specifically designed for people who are signposted to advice after receiving communications about their persistent credit card debt, and will be watching closely for any indications of positive change following the Financial Conduct Authority’s package of measures to address persistent debt in the credit card and overdraft markets.

Types of debt

There was a small but worrying rise in the proportion of new clients with payday or other high cost short-term credit debt. This type of debt was primarily among young clients, with over a quarter (26%) of new female clients and over a third (35%) of new male clients aged under 25 having this kind of debt.

The incidence was much lower in older age groups – just 3% of clients aged 60 or over, and 10% of those aged 40-59, had this type of debt.

Commenting on the findings, our CEO Phil Andrew said:

“The number of people who contacted us last year works out at one every 48 seconds – a record level of demand. That’s the scale of the debt problem in the UK, and our advisors hear every day the devastating impact that debt can have on people.

"While a huge amount has been done to support people in problem debt and reform credit markets, our client insight shows that there’s still much more for government, policy makers and creditors to consider.

“In line with the strategy we launched last summer, we’re working flat out to be able to double the number of people we can help over the next few years. While debt can strike at any age, on average our clients are getting younger.

"It’s important that policymakers work to help turn the tide and prevent debt becoming an inevitable rite of passage for young adults.”

Notes to Editors

- The full Statistics Yearbook 2018 and the associated Excel spreadsheet can be accessed on the website.

- The Yearbook’s editor, Josie Warner, blogs on additional insights from the 2018 data.

- More information on our published debt research and our four-year strategy is available on the website.