Looking for the most recent personal debt statistics?

This page gives a summary of our 2016 Statistics Mid-Yearbook. You can find the most up-to-date personal debt statistics in our 2018 Statistics Yearbook report.

This page gives a summary of our 2016 Statistics Mid-Yearbook. You can find the most up-to-date personal debt statistics in our 2018 Statistics Yearbook report.

Personal debt statistics 2016

In the latest of our statistics yearbook series, the 2016 Statistics Mid-Yearbook provides an update on personal debt trends for the first half of 2016.

Using data from the 300,000 people who contacted us from January to June 2016, this report explores the trends those in problem debt are experiencing.

1. Highest ever demand for debt advice

In the first half of 2016, 313,679 people contacted us for free debt advice by telephone or online, and there were over 1.7 million visits to our website. This is 11% up on the first half of 2015, our next busiest period. On average our clients owed £13,826 in unsecured debt, spread over an average of 5.7 debts.

2. More clients have debts to friends and family

28% of clients have turned to friends and family for loans totalling £200m in the first half of 2016. This compares to 20% of clients just 2 years ago. The average debt to friends and family is now over £4,000, an increase of almost £1,000 since 2014.

"I'm so relieved that (StepChange) can help me! The advice, guidance and non judgmental approach is so appreciated. l can't believe how much weight has been lifted from my shoulders now that you are helping me. I feel like l have a new start now and can definitely go forward.".

Tracey, Worcestershire

3.Demand for debt advice soars in the north east

Although London continues to be the region with the most clients (over 50,000 Londoners contacted us in the first half of 2016) the North East now has the most clients per local population. In half a year alone, 68 in 10,000 of the local population contacted the charity for help, compared to 62 per 10,000 local population in London.

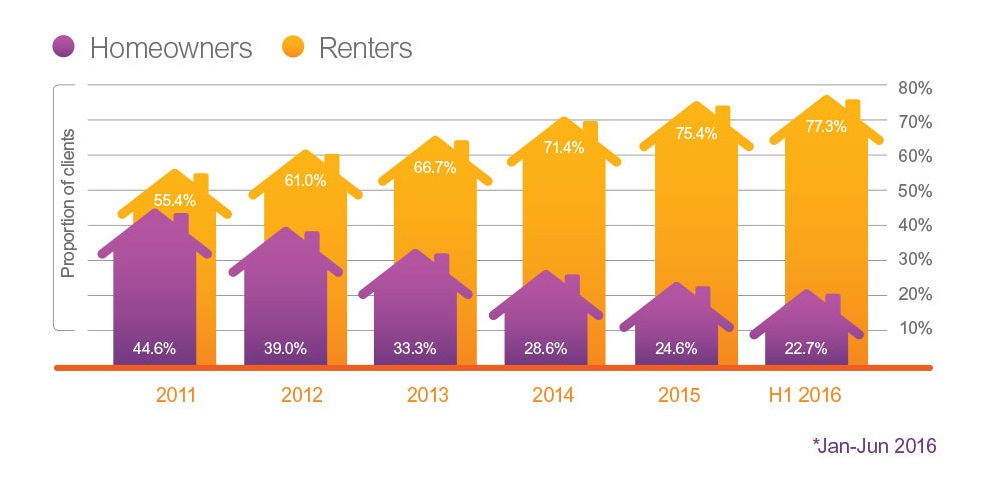

4. Financial difficulties hit renters the hardest

So far in 2016, 77% of our clients live in rented accommodation, compared to a little over 50% five years ago.

5. One in four clients are still behind on essential household bills

The proportion of clients we see with arrears on essential household bills such as council tax, rent and utilities continues to sit at around 40%. This compares to around a quarter in 2011.

For clients with these arrears, the average council tax arrears is £957 and rent arrears is £954. 24% of clients are in arrears with their water bills to an average of £739.

A change to income or employment is still the most common reason for our clients falling into debt. One in five clients fell into problem debt due to losing their job, and 15% due to injury or illness.

StepChange have been a life-saver for me. I was paying out over £1000 more a month than I was earning, and getting into a mess by using credit cards to keep up with the payments. In the end, I contacted StepChange. They sorted everything out for me, got in touch with all my creditors, and now I pay just over £250 a month. Everything was done online...I would recommend them to anyone who is struggling financially."

Anonymous, Essex, Client since July 2015