Personal Debt 2014: Statistics Yearbook findings

StepChange Debt Charity's Statistics Yearbook 2014 paints a thorough picture of personal and household debt trends in the UK. We highlight the main causes of problem debt, the most common types of debt, and who is most at risk of falling into debt.

Our key findings

- Growing demand for debt advice – nearly 600,000 people contacted StepChange Debt Charity in 2014, up 56% since 2012

- Single parents and under-25s worst affected - debt problems are rising fastest among these two groups; single parents are significantly over-represented among the charity’s clients when compared to national figures

- Insecure work and housing – an increasing proportion of the charity’s clients are in part time work and rented accommodation

- More people behind on essential bills – 39.8% of the charity’s clients are in arrears on at least one essential household bill (including rent, energy bills, council tax), up from 34.9% in 2012

1. Growing demand for debt advice

2014 is the third successive year in which demand for advice from StepChange Debt Charity has increased - a record 577,677 people contacted us through telephone and online channels.

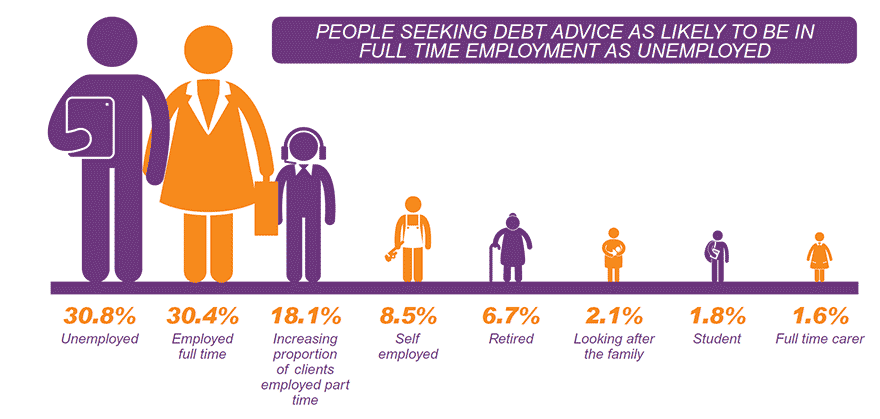

As the graphic below demonstrates, just as many people in full-time employment (30.4%) as unemployed people (30.8%) got in touch with us for debt advice. We have also seen an increasing proportion of clients who are employed part time (18.1%).

Click here to view (opens in new window)

"I was running out of money...before you know it you're filling up the car with petrol and doing the food shopping all on credit card."

Rosie, Leicestershire

2. Single parents and under-25s worst affected

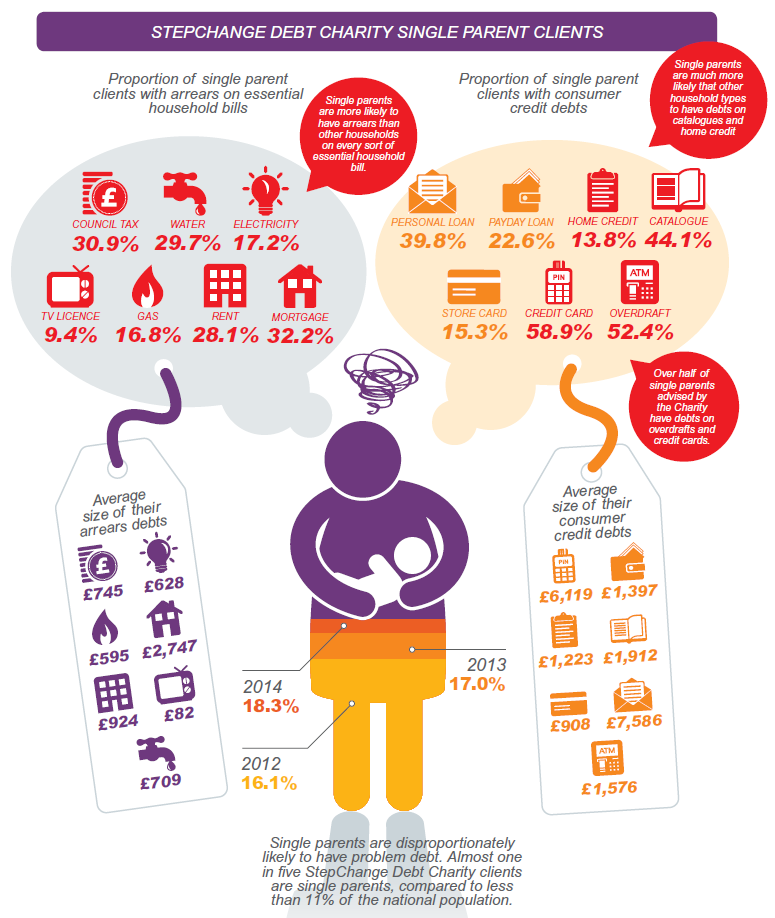

Those aged 18-25 now represent 13% of StepChange Debt Charity clients, and single parents account for nearly 1 in 5 people the charity advises.

As the graphic below shows, single parent households are more likely than other households to be in arrears on essential bills. They are also more likely than other household types to have catalogue and home credit debts.

We invited Action for Children to give their view on our findings.

Click here to view (opens in new window)

3. Insecure work and housing

Around a quarter of clients in 2014 said unemployment was the reason for seeking debt advice, while a further 12.8% of clients said that a reduced income was the main contributing factor for their debt.

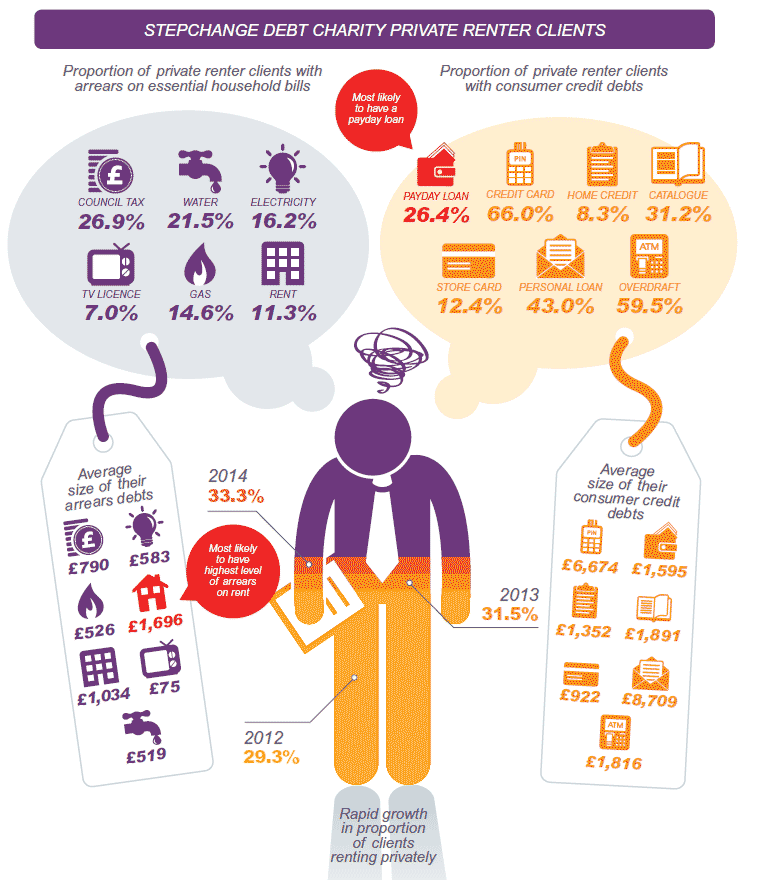

Almost three-quarters (71.4%) of clients now live in rented accommodation, compared to 61% in 2012. We invited Shelter to give their view on these findings.

Click here to view (opens in new window)

"Statutory Sick Pay wasn't enough to live on and I didn't have enough to service my debts, let alone pay rent etc. It spiralled quite quickly...for a period it completely destroyed my life."

James, Gloucestershire

4. More people behind on essential bills

Since 2010, the number of clients completing an advice session with us with arrears on essential household bills has increased from 45,815 to 135,631.

As the graphic below highlights, this means nearly two in five clients (39.8%) were in arrears on priority debts during 2014.

![This graphic shows StepChange Debt Charity clients' arrears on essential household bills]()

Click here to view (opens in new window)

"Going to our bank for help made us feel awkward, embarrassed and under pressure to make repayments we just couldn't afford."

Faye and Nick, West Midlands

Download the report now to see our full research and recommendations.

Download now