Borrowing on a low income and the need for affordable credit

Too many families on low incomes are turning to high cost credit as a 'safety net' to pay for everyday household costs.

Examples of these instances include taking out payday loans to pay for the family's weekly food shop or using costly rent-to-own stores to buy a replacement washing machine. Our latest research looks at what sort of affordable credit can help low income households, so they don't have to turn to high cost credit.

The problems of high cost credit

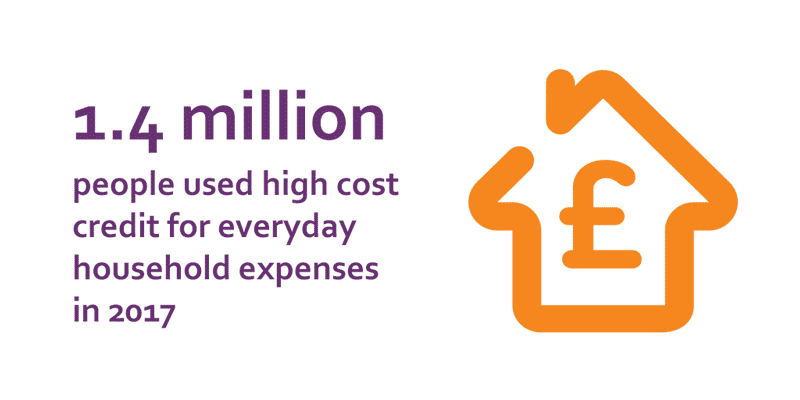

We recently found that an estimated 1.4 million people used high cost credit for everyday household costs in 2017, up from 1.1 million in 2016.

Regularly relying on high cost credit puts added pressure on already tight budgets and leaves households particularly vulnerable to falling into problem debt.

What do lower income households need?

Using the Joseph Rowntree Foundation’s Minimum Income Standard (MIS), we identified three main lower income groups:

Households living just below the MIS

They're likely to have to borrow to meet unexpected costs, but even with a considerable expansion of community lending, interest-bearing credit isn't viable for some.

Those living on 75% of the MIS

They don't have enough income to meet their needs, are more likely to need to borrow more regularly to cover the cost of essentials, and are unlikely to be able to repay most forms of commercial credit.

Households classed as being in 'destitution'

They can't afford the absolute essentials, such as feeding their family or keeping a roof over their heads, and would struggle to afford to repay even a loan with no interest.

Our recommendations

One type of affordable credit alternative won't be suitable for all of those living below the MIS. There's a need for a mixed and expansive provision of affordable credit alternatives and grant based emergency support. We recommend:

- A sustained and long-term programme to expand the provision of community lending

- The UK and devolved governments lead the development of no-interest loan provision

- Increased and more secure funding and the ring-fencing of local welfare provision for those facing destitution

Download the report now to see our full research and recommendations

Download now