Turning to credit to get by

Our new report looks at consumer credit trends in Britain, the use of credit as a safety net and how this can lead to personal debt problems. It also highlights strategies and solutions to address the use of unsustainable credit and the resulting financial difficulties.

For many, credit is a sustainable tool to smooth out consumption, spreading the cost of larger purchases with manageable repayments. However, families on tight budgets who regularly use credit to meet their everyday essentials and emergency costs can fall into problem debt.

The scale of the problem

This is a widespread problem with over 7 million people in Britain turning to credit to pay for their everyday essentials at least occasionally and over 13 million who would need to borrow money to cover emergency costs.

In total, we estimate over 4 million people in Britain are likely to be using credit as a safety net as they struggle to meet both everyday living costs and emergency costs without turning to credit. This group is largely made up of working families on low to middle incomes, although some are households on the lowest incomes and in more insecure, ‘casual’ employment.

Issues in the current consumer credit market

In order to explore why using credit as a safety net can lead to problem debt, we surveyed StepChange Debt Charity clients and reviewed the existing literature. We found three main issues in the current credit market.

1. Using credit to plug gaps in household finances

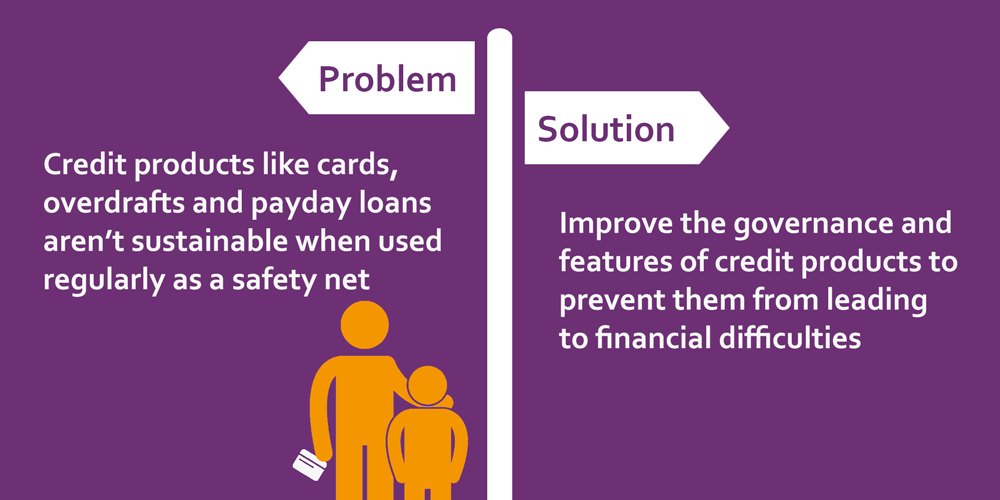

Firstly, there are features of the most commonly used credit products including credit cards, overdrafts and payday loans that can lead to problem debt where they are regularly used to plug the gaps in household finances. These problematic features and behaviours include irresponsible lending, costly and complex default fees and charges, the fact that individuals often have multiple products, and the structure of minimum payments.

The FCA has gone some way to tackle the worst excess of the unsecured credit market particularly with payday lending. However, more needs to be done to address the issues with both high cost and mainstream credit products to reduce the risk of people using them as a safety net falling into problem debt. Our report proposes new strategies needed to reduce the ‘debt risk’ of credit products.

2. Having no alternative to high-cost credit

Secondly, we found that some of those using credit as a safety net are not able to access mainstream credit and are having to pay more when turning to high cost credit. This credit use is also not always sustainable as it can also lead to spiralling problem debt. The need to provide affordable credit alternatives to the high cost sector has been key debate since the explosion in payday lending.

The community lending sector including credit unions and community development finance institutions (CDFIs) is providing a growing source of affordable credit but still has limited reach. There is a need to further expand the supply of accessible, suitable and sustainable credit for those who struggle with access.

3. Using credit as a safety net in times of crisis

Another issue is that some people who use credit as a safety net are using credit in crisis situations and out of desperation. For some accessing any form of credit may not be the answer particularly if they are already in severe financial difficulties.

There is a need to reduce the demand for ‘crisis’ credit use and implement a preventative strategy to improve the safety nets available for those that struggle on tight budgets and regularly face emergency income shocks.

Tackling the use of unsustainable credit

As the report highlights, a broad strategy and numerous solutions are needed to address the unsustainable use of credit and the resulting financial difficulties in Britain today. This includes the need to reduce the ‘debt risk’ in current products for those using them as a safety net and to provide an alternative supply of affordable credit for those that struggle to access commercial credit. There are also broader strategies needed to tackle the demand for credit and improve the safety nets for those who fall into difficulties.

A multi-faceted approach is essential to ensuring credit is used sustainable as a safety net and to tackling problem debt in Britain.

Download the report now for the full picture.

Download now