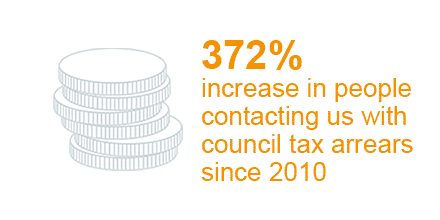

Council tax arrears: our main findings

The charity is calling on the government to implement changes to help people with the growing arrears crisis tipping families into problem debt. Our clients now owe an average of £832 in council tax arrears, an increase of £157 since 2010.

Eight in 10 clients got in touch with their council about the council tax arrears, but a majority of them faced threats of legal enforcement or demands for unaffordable lump-sum payments from the council:

- 62% of people had still been threatened with court action

- 51% had been threatened with bailiffs

- Only 25% were offered an affordable payment option

- Only 13% were encouraged to get debt advice

Tough actions by councils make people three times as likely to take out a payday loan, twice as likely to borrow money from friends and family and almost 50% more likely to fall behind on other bills to pay the demand.

Of those who faced aggressive enforcement, 49% agreed to an unaffordable repayment plan and 47% fell behind on other bills. Of those subject to bailiff action, 93% said that it increased their levels of stress and anxiety and 63% said that it put a strain on their family.

Councils desperately need the revenue from council tax and they have a duty to collect. But we worry that tough enforcement and unaffordable demands pushes people into greater financial difficulty and is actually counter-productive.

Problem debt has social costs of £8.3 billion, much of which is shouldered by councils, such as the cost of people losing their home and relying more on care and support services.

We believe councils can increase their returns and reduce the risk of displacing these costs, by focusing on affordable, sustainable repayment. Councils are under pressure from local government to collect council tax “in year” and are named and shamed based on these collection rates.

Despite this pressure council tax collection rates fell in 2013/14, only the second fall in the last 20 years. This is a clear indication that the increasingly tough enforcement employed by councils is not effective.The charity is calling on the government to implement the following changes:

- Changes to the Council Tax Administration and Enforcement Act 1992 to place guidance on a stronger legal footing, including ensuring that councils should evidence that they have tried to pursue an affordable repayment plan

- Ensure consistent incentives and messages to councils that reinforce the need for and importance of affordable payment solutions.

- A new individual protection against enforcement of unaffordable repayments for people seeking help with their debts.

Download the report now to see our full research and recommendations.

Download now