What's making debt problems worse? Unfair treatment from creditors holds back those in problem debt

We see the harm that debt causes every day. Our clients tell us how debt has damaged their health, their family relationships and their work life. This report highlights some of the ongoing conduct issues that continue to cause or contribute to the harm experienced by people dealing with severe problem debt.

There are many reasons why people fall into problem debt. We know that income shocks through lost or reduced employment, illness or family breakups are among the most common.

However, the way that people are treated by their creditors is also important. Bad lending decisions, poor product design and aggressive debt collection practices can make severe debt problems more likely, more harmful and harder to deal with.

This report calls for more to be done across the sector to reduce the harm these practices cause for people in problem debt. It outlines a series of recommendations that look to address the key issues uncovered in our analysis.

"How fairly were you treated?"

We asked 1,794 of our clients as series of questions, including whether they felt they had been treated fairly, unfairly or neither fairly nor unfairly by different types of organisation. Each organisation is ranked by the percentage of clients who said they were treated unfairly.

| Rank

|

Type of organisation

|

"I was treated unfairly"

|

| 1

|

Bailiff

|

50%

|

| 2

|

Local authority

|

42%

|

| 3

|

Dept. for Work and Pensions (DWP)

|

36%

|

| 4

|

Mobile phone company

|

32%

|

| 5

|

Debt collection agency

|

30%

|

| 6

|

HM Revenue and Customs (HMRC)

|

28%

|

| 7

|

Payday or short term lender

|

28%

|

| 8

|

Utility company

|

27%

|

| 9

|

Catalogue lender

|

26%

|

| 10

|

Fee-charging debt management firm

|

26%

|

| 11

|

Store card lender

|

23%

|

| 12

|

High street bank

|

21%

|

| 13

|

Credit card company

|

20%

|

The results show a degree of correlation between robust sector regulation and fairer treatment. Bailiffs and public sector creditors score consistently worse than regulated financial services creditors, including high-cost lenders. What’s more, 51% of clients contacted by bailiffs were for council tax debts.

It's important that vulnerable customers are treated fairly by their creditors and debt collectors, so as to not exacerbate the harm caused by their problem debt. When asking clients about any vulnerabilities - beyond their financial vulnerabilities - the report finds that 83% of clients said at least one of their creditors didn’t take these into account after the client made them aware of the issues. 35% of clients said none of their creditors accounted for their vulnerabilities, even after they had told them.

Other key findings from the report

- 43% of clients have had their credit card limit increased without asking for it. This equates to over 130,000 new clients coming to us per year, based on the number of clients we advised in 2015. 30% of clients specifically stated that taking on this extra credit has made their debt problem worse.

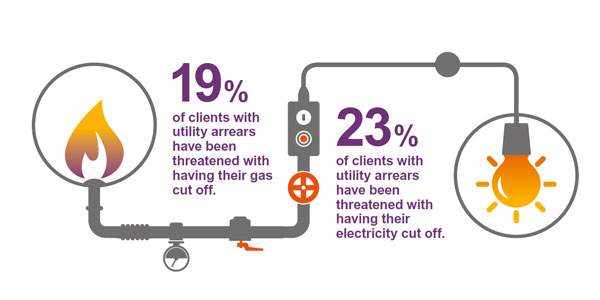

- 19% of clients had their gas threatened to be cut off, and 23% had electricity threatened to be cut off. Just 1% actually had utilities cut off.

- 16% of clients have been contacted by a bailiff in the last two years

Our five recommendations to improve creditor conduct

Based on the evidence in this report, it's clear that more needs to be done to support indebted consumers in vulnerable situations.

We conclude that:

- The Ministry of Justice should re-evaluate policy on enforcement agents and consider how to better control bailiff conduct; ensure people in financial difficulty are able to make affordable repayments that do not make existing debt problems worse; and firm up standards protecting vulnerable customers so that these always work in practice.

- Local and central government should commit to binding good practice standards that prioritise supporting households to financial recovery. Since 2009, we've seen a large increase in the proportion of clients struggling with council tax debts.

- We call for a new focus to ensure that debt recovery practices and policies have affordable and sustainable repayments at their heart. The energy sector has a relatively good track record on considering the needs of people in vulnerable situations. However, this survey suggests that this is not always translating into fair treatment of people in financial difficulty.

- We would like to see people who seek advice for debt problems given a period of six months to a year of ‘Breathing Space’, in which interest and charges are frozen and enforcement action is halted. This would allow time to recover finances and commit to affordable repayments.

- The FCA should ensure that credit card limits are only increased where the borrower actively opts-in to this. Based on the evidence in this report, we believe that credit limit increases should become opt-in, rather than opt-out, to help stop people being given credit that they did not actively decide they needed or that they could afford.

Download the report now for the full picture.

Download now