How Britain's lack of financial resilience is tipping people into a debt trap

People will always face ups and downs that they have to adjust to, but recent trends in the jobs market, with fewer working people in traditional permanent, full-time, steady-wage jobs, mean more people experience more frequent shocks and changes as part of everyday life.

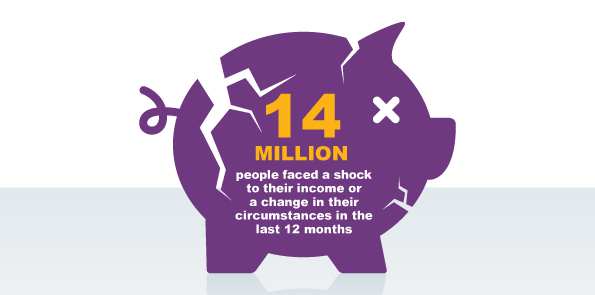

Almost 14 million Britons faced an income shock or a change to their circumstances in the last year. But those working zero hours contracts, fixed term jobs and the self-employed were twice as likely to see a drop or interruption in their income.

This means that more than ever, people need safety nets to weather shocks and changes. Safety nets are effective options for managing falls and interruptions in income – and include welfare benefits, savings and insurance.

Welfare benefits are being reformed to incentivise work, by mirroring work – a welcome principle. But these reforms need to be balanced to ensure that welfare benefits also acts effectively as a responsive safety net to the ups and downs of modern working life, in a world where fewer and fewer people have savings to fall back on.

Savings and welfare benefit gaps mean that in the last year 6.5 million people used credit to keep up with their outgoings after a change in their circumstances. Those who relied on credit in an emergency were more likely to be on low and middle incomes, less likely to have savings, and lacked confidence that the welfare benefits system would help them adjust.

Debt and credit

A quarter of those who relied on credit – 1.7 million people – ended up in severe problem debt within a year. They were twenty times as likely to be in severe problem debt as those who didn’t rely on credit.

So many people fall into severe problem debt when they use credit in an emergency, because credit commitments build up as people struggle to pay next month’s bills, plus last month’s, plus interest.

Caught in a debt trap

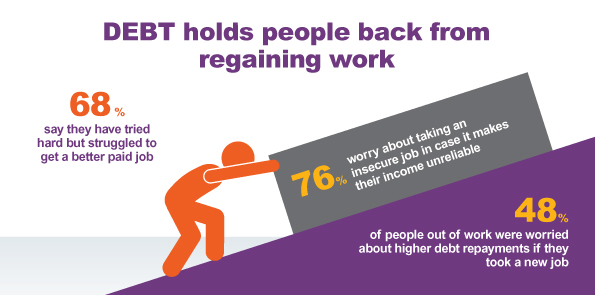

Once in debt, people face additional barriers to regaining work, are less productive when they are in work, and lose confidence in their ability to progress in their career. Severe problem debt turns everyday obstacles into long term problems.

To avoid unnecessary barriers to work and drags on productivity, government must ensure that people working hard and doing their best in the modern labour market have safety nets that help them cope with ups and downs and avoid the debt trap.

Download the report now for the full picture.

Download now