"There are a number of important, sobering aspects to the StepChange Debt Charity Statistics Yearbook. But as an employee at the housing and homelessness charity Shelter, my main concern is with the debts that could lead to people losing their home and the underlying housing trends that exacerbate problem debt.

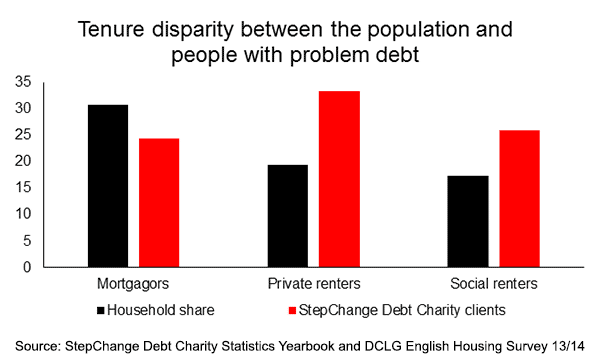

"From this perspective there is one clear story: that renters are disproportionately struggling with problem debt and that private renters appear particularly vulnerable.

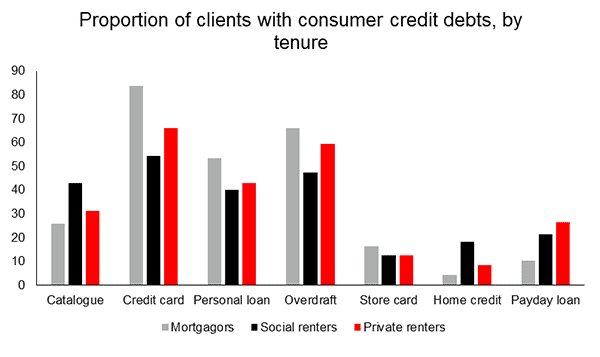

"A third of StepChange Debt Charity clients last year were private renters, compared to just a fifth of the population. And the extent of their debt problems appear to be at least as bad as social renters’ and mortgagors’. They have more catalogue and home credit debt than mortgagors, more credit card, personal loan and overdraft debt than social renters. And more payday loan debt than either of them.

"In many ways this comes as no surprise. Renters – both social and private – tend to be on lower incomes and people on lower incomes tend to have more trouble with debt. But the particular challenge faced by private renters exposes a break in the link between income levels and the prevalence of problem debts. Private renters are generally wealthier than social renters so they ‘should’ be less likely to have trouble with debt. According the Yearbook, the opposite is true.

"What’s happening? Although private renters are on higher incomes, we know that they typically pay a larger proportion of their income in rent, with the average private renter spending 40% of their net income on rent. To put that into context, paying 35% out in rent is considered to be the limit of what’s affordable; any more than that and you are likely to have difficulty making ends meet. The higher occurrence of problem debts for private renters clearly shows one of the consequences of the private rented sector’s affordability problem.

"This is obviously a problem in itself, because high housing costs can compound debt problems and leave little for other essential bills.

"But it’s also a problem because we know that private renters are more at risk of losing their home than people in other tenures – and that struggling to pay the rent might well lead to them losing their home.

"At the moment in England, private renters have no protection from eviction once the fixed period of their tenancy is up. So if you fall into rent arrears as a private renter your landlord can ask you to leave. Even if your rent arrears are small and even if you manage to pay them off quickly, your landlord can still ask you to leave if you begin to look a bit risky. In fact, landlords don’t legally need any reason at all to evict under 'Section 21' of the 1988 Housing Act.

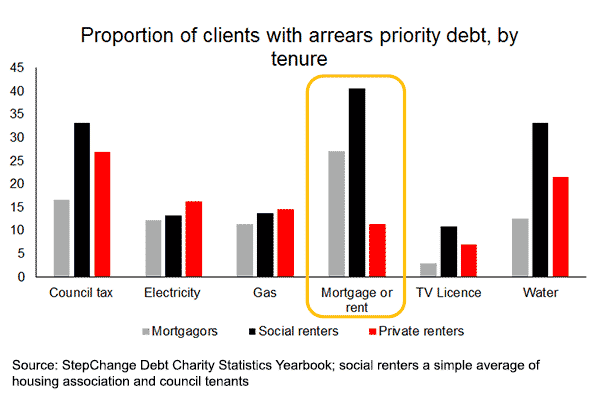

"In contrast, mortgage lenders and social landlords are obliged to consider leniency with payments before they start repossession proceedings and are only likely to gain a possession order when the arrears are large or longstanding. This is one of the reasons that the end of a private rented tenancy has now become the leading cause of homelessness.

"This lack of protection for renters may help to explain one quirk in the yearbook: the very low levels of private renters who are in arrears on their rent. While private renters have high levels of other debt and arrears, their low levels of rent arrears may demonstrate that they understand the serious risks of slipping behind on the rent. The worrying implication is that private renters are turning to high interest pay day loans and door step lenders as the less scary alternative to falling behind with their landlord.

"The challenges of debt illustrated by the StepChange Debt Charity Statistics Yearbook for private renters are twofold. The high cost of their housing means that they are more likely to end up in debt, and they are more at risk of losing their home as a result. Clearly, as the number of the people living in a private home continues to grow something needs to help renters confront both of these. That means both bringing housing costs down over the long term by building more homes, and providing longer term tenancies to avoid unreasonable eviction.