Personal Debt 2013: Statistics Yearbook findings

- A record number of people, 507,863, contacted StepChange Debt Charity in 2013. This was driven by a 29 percent increase in the number of people contacting the charity by telephone and a 50 percent increase in the number of people contacting the charity online

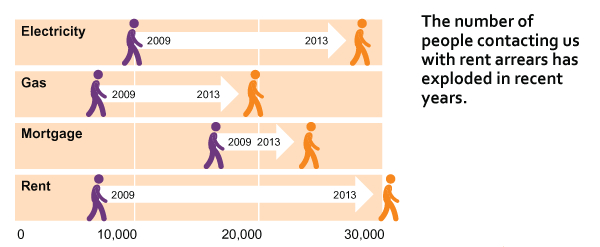

- The proportion of people who live in rented accommodation seeking advice from the charity continues to grow. Last year almost 70 percent of clients advised lived in rented accommodation, compared to just over 50 percent in 2009

- As in previous years, demand for advice was primarily a result of unemployment (23 percent) and reduced income resulting from a loss of hours at work (16 percent)

- Being in work does not necessarily make people free from debt problems; over half of clients seeking help were in work, 31 percent employed full time

- Relying primarily on income from jobseeker’s allowance means that people do not have enough money to meet their essential spend. Clients receiving this benefit have, on average, significantly higher outgoings than income

- The results of our client survey showed that indebted consumers still continue to wait too long before seeking debt advice. Half of those surveyed waited more than a year between realising their debts were a problem and seeking help from any debt advice provider

- Our survey also showed the huge psychological impact problem debt can have on individuals. Three-quarters of respondents experienced sleeping problems due to their debt problems, and 64 percent experienced mood swings. Over 50 percent have also found their work performance suffered as a result of problem debt

- Payday loans continue to cause huge problems for consumers. StepChange Debt Charity clients with payday loans have on average three, with the average payday debt (£1,647) outstripping average income

- The last five years have seen a huge rise in the proportion of StepChange Debt Charity clients with arrears on household expenditure. The largest rise has been in Council Tax arrears, where the proportion of clients with missed payments has increased from less than 10 percent in 2009 to over 25 percent in 2013

- The charity has also seen big rises in the proportion of clients with arrears on utility bills. Around 13% of clients have arrears on gas and electricity bills

Download the report now to see our full research and recommendations.

Download now