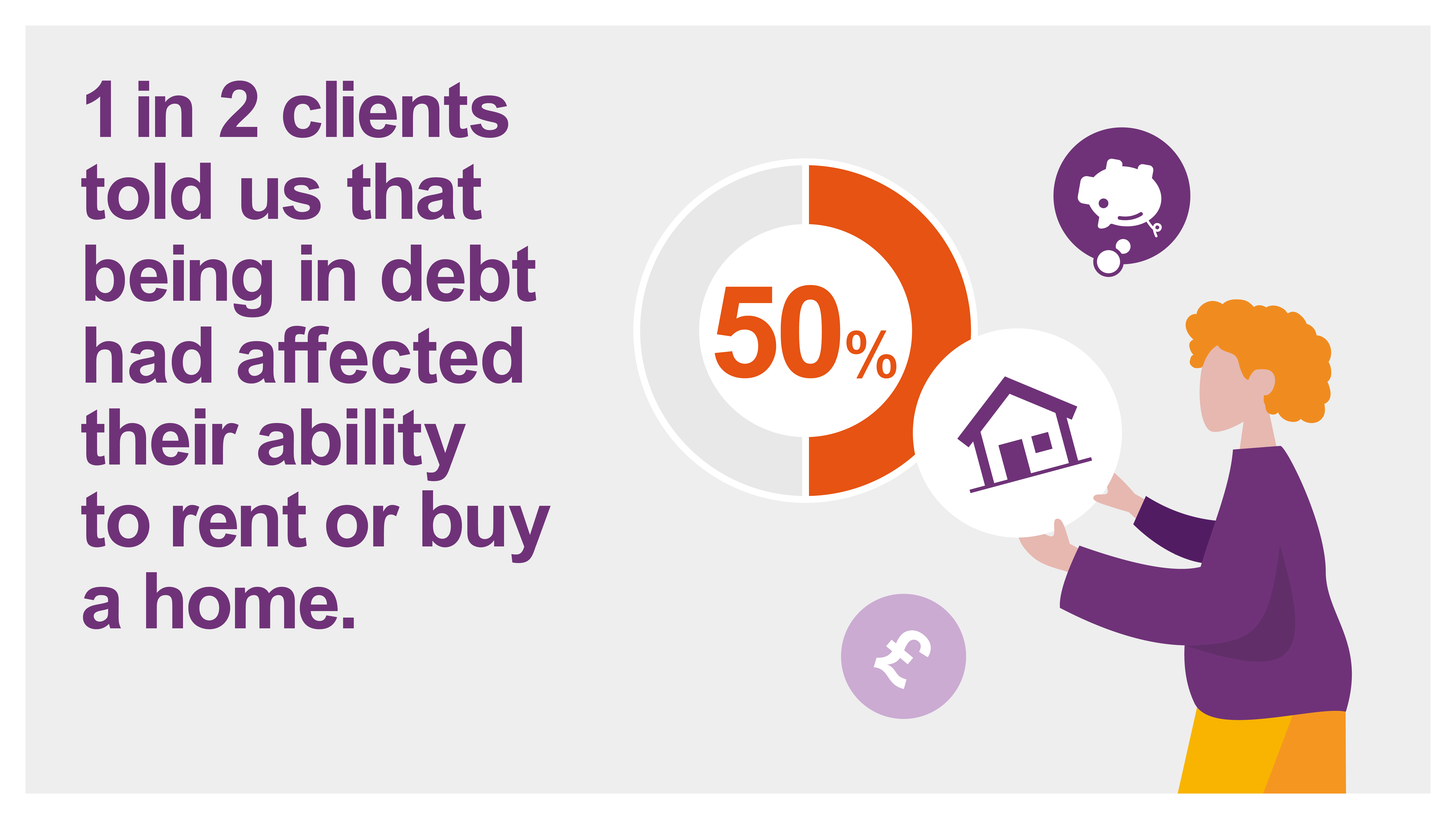

Problem debt causes housing insecurity and is a significant barrier to renting or buying a new home.

As a result of their experience of problem debt, 22% of PRS respondents felt pressured to move and 15% were threatened with eviction. 4% were evicted, 6% had moved to temporary accommodation and 6% became homeless.

The PRS can be an unsafe place for people who are struggling with debt.

58% of survey respondents stated that they were experiencing at least one quality issue which affects the extent to which their home meets the Decent Homes Standard.

15% of PRS respondents who experienced quality issues did not report problems with their home for fear of being evicted.

PRS housing problems have impacts on health, wellbeing and work.

75% of PRS survey respondents told us that housing issues had affected their own or their family’s health and wellbeing, including direct impacts on health conditions as well as the impact of housing worries on mental health problems.

18% of PRS respondents told us that housing issues affected their ability to work, including the impact of health problems on time off work and difficulties moving for work due to unaffordable housing.