Looking for the most recent personal debt statistics?

This page gives a summary of our 2015 Statistics Yearbook. You can find the most up-to-date personal debt statistics in our 2018 Statistics Yearbook report.

This page gives a summary of our 2015 Statistics Yearbook. You can find the most up-to-date personal debt statistics in our 2018 Statistics Yearbook report.

Personal debt statistics 2015

Each year, our Statistics Yearbook takes a closer look at personal and household debt trends in the UK. This year, we’ve seen more people in financial difficulty who are working part-time and living in rented accommodation, and more families struggling with essential household bills.

What are the most common types of debt in the UK? What are the main causes of problem debt and who is most at risk? We take a look at the key findings from our 2015 Statistics Yearbook.

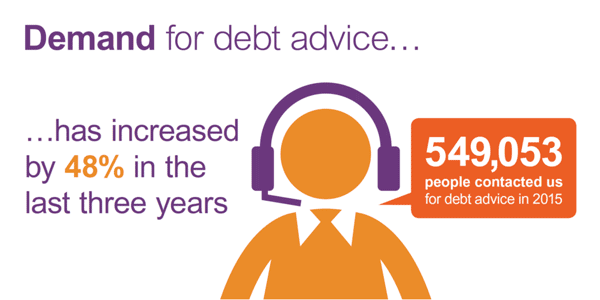

1. Continued high demand for debt advice

In 2015, we continued to see a high demand for free debt advice. Throughout the course of the year 549,053 people contacted us by telephone or online, and there were over 3 million visits to our website. On average our clients owed £13,900, spread over an average of 5.6 debts.

2. More people are behind on essential bills

In 2015 we advised a much greater proportion of clients with priority arrears. 40% of our clients are behind on payments on essentials such as council tax, rent and utilities. In 2011, this was the case for just a quarter of our clients.

"StepChange have been instrumental in advising, explaining and showing me how to get on top of my debts. As of April 2015 I've managed to pay off £904 of rent arrears, a credit card debt of £950, and make 3 payments towards my council tax arrears. StepChange’s assistance has had a phenomenal effect in my case.”

Anonymous, Middlesex, Client since December 2014

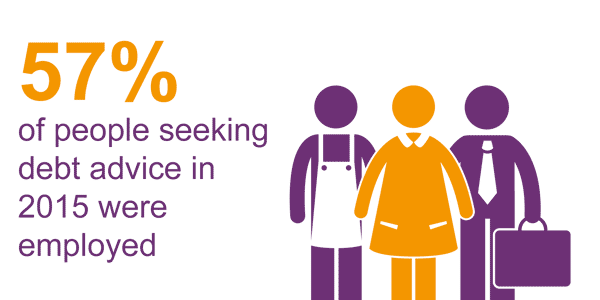

3. More people working part-time in problem debt

More than half (57%) of those who came to us for debt advice in 2015 were employed. But of these, fewer people have full-time jobs, and more people have part-time jobs.

The biggest cause of falling into debt is an income or employment change. One in five clients fell into problem debt due to losing their job, and a further 15% due to reduced or irregular income.

StepChange have been a life-saver for me. I was paying out over £1000 more a month than I was earning, and getting into a mess by using credit cards to keep up with the payments. In the end, I contacted StepChange. They sorted everything out for me, got in touch with all my creditors, and now I pay just over £250 a month. Everything was done online...I would recommend them to anyone who is struggling financially."

Anonymous, Essex, Client since July 2015

4. Financial difficulties are hitting renters hardest

The vast majority (75%) of our clients now live in rented accommodation, up from 55% five years ago. The costs associated with renting are rising, and as a result vulnerability to income shocks and unexpected costs has also grown.

Download the Statistics Yearbook 2015 for the full picture.

Download now